Credit Risk Management

A holistic approach to managing risk within credit portfolios is essential in today’s fast-paced highly regulated environment. Our team of experienced professionals can offer financial institutions an inclusive credit risk management system to help them keep their institutions safe, sound, and compliant. Each component can work independently, or together, based on an institution’s needs and complexities. Our cohesive, technology-infused approach to the credit risk function is delivered through our LoanReviewPRO, StressTestPRO, and CECLAdvisorPRO® suite of services.

LoanReviewPRO

An effective Credit Risk Review function is integral to the safe and sound operation of insured depository institutions. The results of the credit risk review can help confirm if the Allowance for Credit Losses (ACL) adequately reflects risk in the institution’s loan portfolio, as well as providing critical information for the implementation of Current Expected Credit Losses (CECL). The credit risk review system focuses on the assessment of credit quality in the credit portfolios, which is an important input into the determination of the ACL. An effective credit risk review system considers the information available that can impact or provide insight into the quality of the portfolio.

LoanReviewPRO is a secure cloud-based solution designed to help you protect one of your most valuable assets – the loan portfolio. Our LoanReviewPRO services bring you a technology solution to make managing credits risks more efficient than ever.

Why choose LoanReviewPRO for your institution?

StressTestPRO

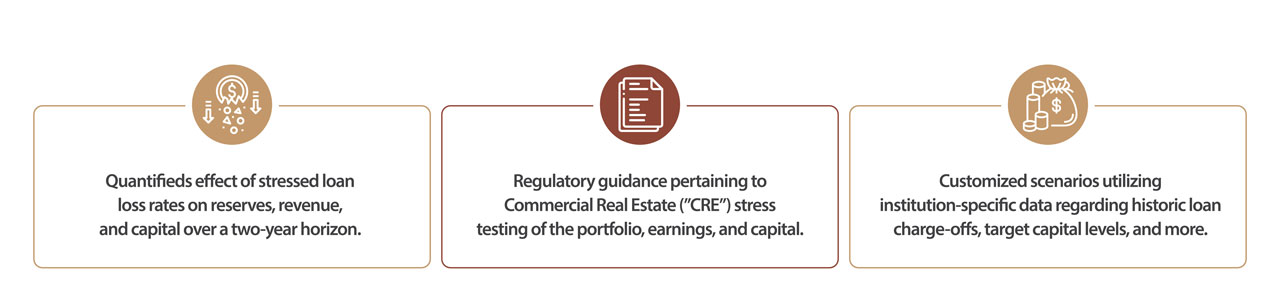

Community banks, regardless of size, should have the capacity to analyze the potential impact of adverse outcomes on their financial conditions. The various types of stress test methods that financial institutions may use should match their unique business strategy, size, products, sophistication, and overall risk profile.

Our StressTestPRO solution can offer:

CECLAdvisorPRO

CECL allows expected credit loss estimation approaches that build on existing credit risk management systems and processes, as well as existing methods for estimating credit losses. However, certain inputs into these methods will need to change to achieve an estimate of lifetime credit losses. To estimate expected credit losses under CECL, institutions will use a broader range of data than under existing accounting standards. These data include information about past events, current conditions, and reasonable and supportable forecasts relevant to assessing the collectability of the cash flows of financial assets.

What Our Clients Say

“We are very pleased with the ability to upload, comment, and see exceptions in real-time. Also, we are ecstatic about LoanReviewPRO‘s summary pages, graphs, etc.”